Mettez-vous hors ligne avec l'application Player FM !

Money Talk Podcast, Friday Sept. 20, 2024

Manage episode 440959349 series 1036924

Advisors on This Week’s Show

with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik

Week in Review (Sept. 16-20, 2024)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

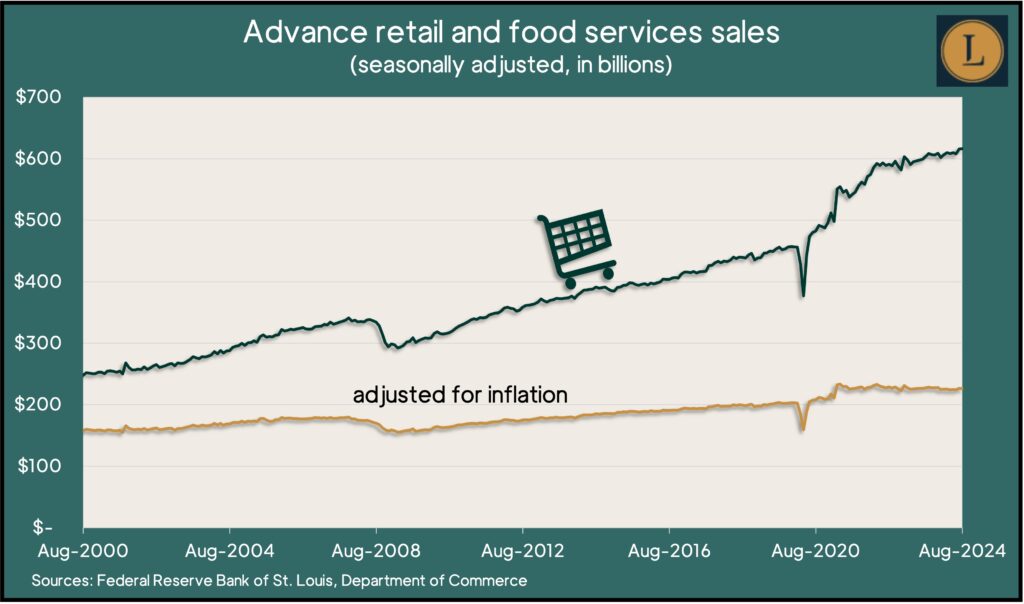

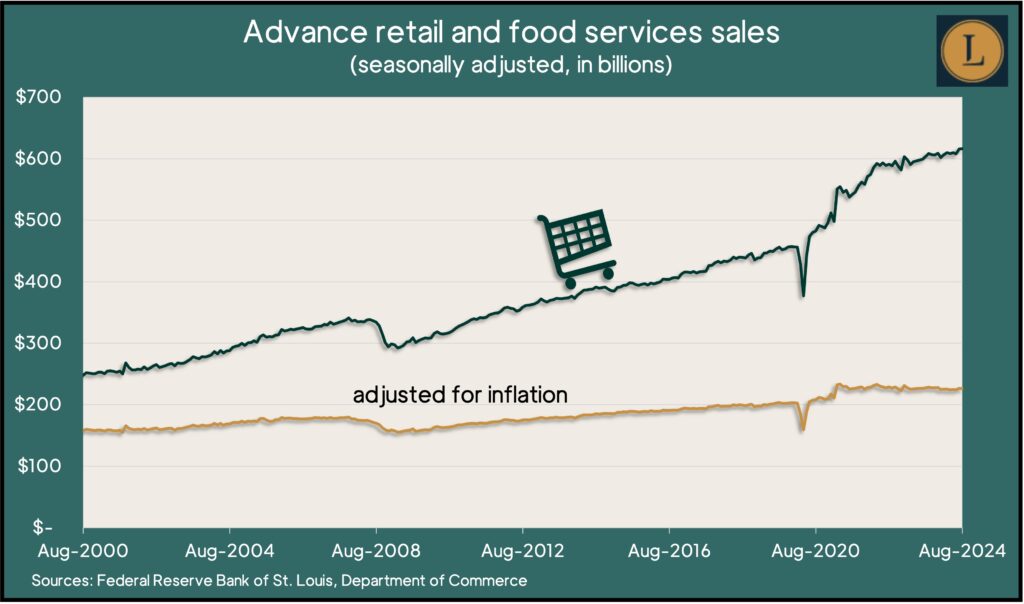

The Commerce Department reported a 0.1% rise in retail sales in August. Sales rose in only five of 13 categories, led by online retailers. Decliners included car dealerships, supermarkets and gas stations, where lower prices meant a drop in revenue. Adjusted for inflation, retail sales fell 0.1% in August.

U.S. industrial output rose 0.8% in August, bouncing back from a 0.9% setback in July. The auto industry was the chief driver, the Federal Reserve reported. Output at U.S. car factories rebounded in August after seasonal plant shutdowns in July. Since August 2023, overall industrial production was unchanged, with manufacturing output up 0.2%. Meanwhile, capacity utilization rose marginally but remained below the 50-year average for the 18th month in a row.

Wednesday

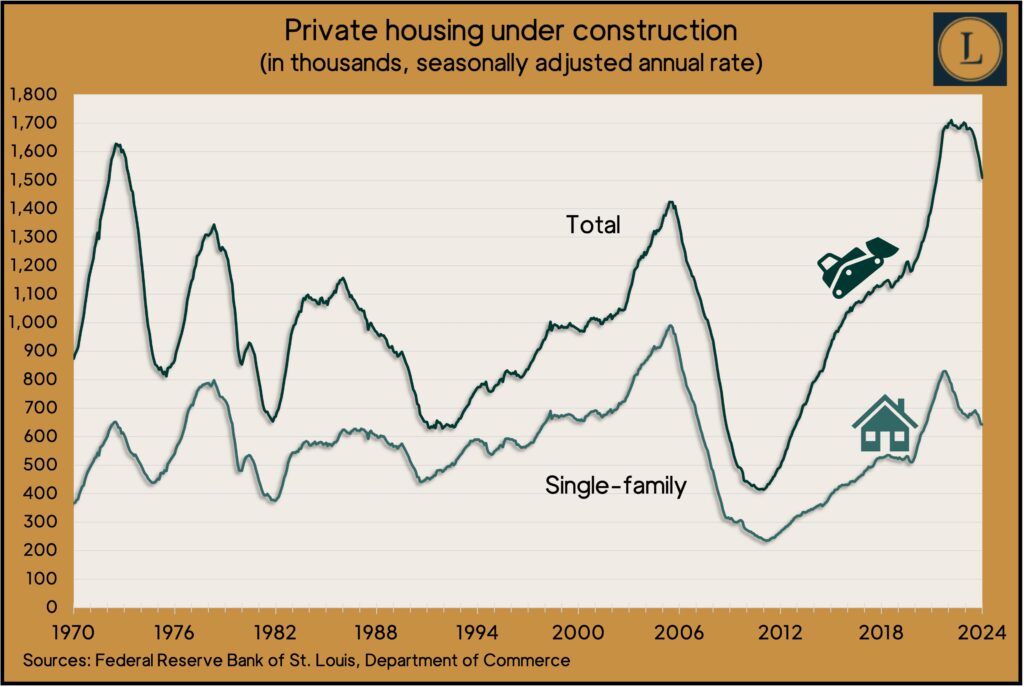

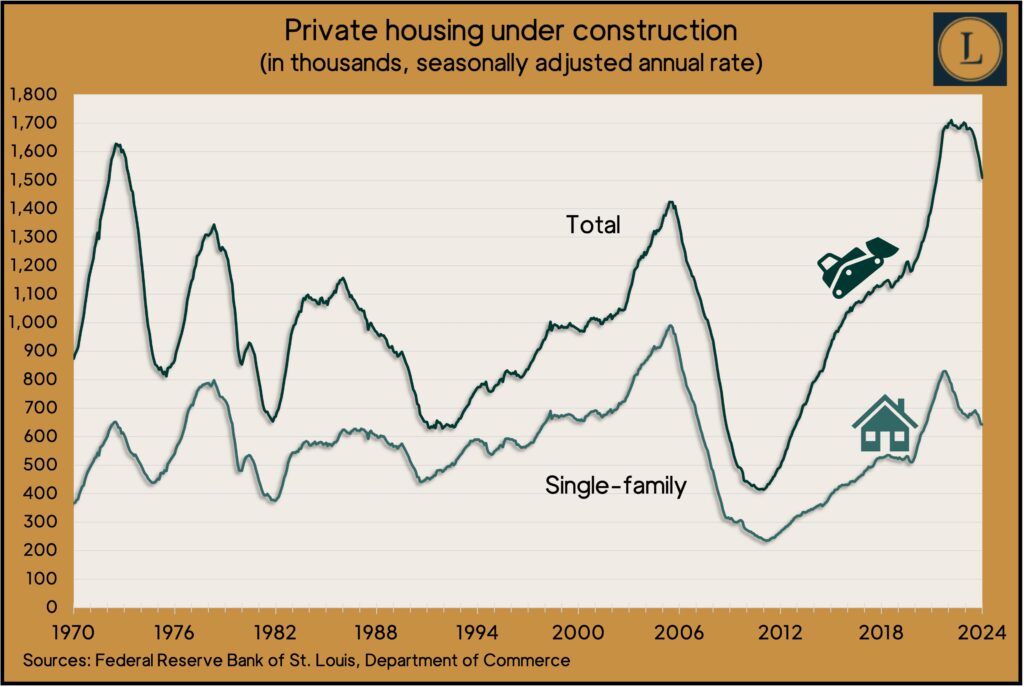

Rates of housing starts and building permits picked up in August, according to the Commerce Department. The annual pace of starts rose nearly 10% from July and were about 4% above the year before, with critical single-family structures taking the lead in both periods. For the sixth month in a row, housing starts lagged the level set before the pandemic, which was the fastest pace of building since late 2006. Housing permits – an indication of future housing construction – rose almost 5% from July and were down 6.5% from August 2023. The pace of houses under construction remained among the highest in 50 years, though it was about 12% below the all-time peak set two years ago.

The policy-making body of the Federal Reserve Board reduced short-term lending rates and signaled more cuts are on the horizon. The Federal Open Market Committee reversed two and a half years of efforts to combat inflation by raising interest rates to their highest level in more than 20 years. The Fed’s aggressive half-point cut in the fed funds rate signaled its confidence in taming inflation while shifting attention to the health of the labor market.

Thursday

The four-week moving average for initial unemployment claims declined for the fifth time in six weeks. The measure was 38% below the all-time average and the lowest since early June, according to data from the Labor Department, a sign of employers’ continued reluctance to let workers go. Barely 1.7 million Americans were receiving jobless benefits in the latest week, down from 5% the week before but up 3% from the year before.

The annual rate of existing home sales fell in August for the fifth time in six months, dropping 2.5% from July’s pace and down more than 4% from the year before. The National Association of Realtors said an increase in inventory and a decrease in mortgage rates should boost sales activity in coming months. The median sales price hit $416,700 in August, up 3% from the year before and the 14th consecutive month of year-to-year price increases.

The Conference Board’s index of leading economic indicators declined in August for the sixth month in a row. The index fell 0.2% from July because of weaker factory orders, consumer expectations and stock prices as well as a negative interest rate spread. But August’s decline was less than July’s, and the six-month slide of 2.3% compared to a 2.7% setback in the previous six months. The business research group projected weaker economic growth for the rest of 2024 but said activity should pick up in 2025 because of the Fed’s plans to lower interest rates.

Friday

No major announcements

Market Closings for the Week

- Nasdaq – 17948, up 264 points or 1.5%

- Standard & Poor’s 500 – 5703, up 77 points or 1.4%

- Dow Jones Industrial – 42062, up 668 points or 1.6%

- 10-year U.S. Treasury Note – 3.73%, up 0.08 point

138 episodes

Manage episode 440959349 series 1036924

Advisors on This Week’s Show

with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik

Week in Review (Sept. 16-20, 2024)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

The Commerce Department reported a 0.1% rise in retail sales in August. Sales rose in only five of 13 categories, led by online retailers. Decliners included car dealerships, supermarkets and gas stations, where lower prices meant a drop in revenue. Adjusted for inflation, retail sales fell 0.1% in August.

U.S. industrial output rose 0.8% in August, bouncing back from a 0.9% setback in July. The auto industry was the chief driver, the Federal Reserve reported. Output at U.S. car factories rebounded in August after seasonal plant shutdowns in July. Since August 2023, overall industrial production was unchanged, with manufacturing output up 0.2%. Meanwhile, capacity utilization rose marginally but remained below the 50-year average for the 18th month in a row.

Wednesday

Rates of housing starts and building permits picked up in August, according to the Commerce Department. The annual pace of starts rose nearly 10% from July and were about 4% above the year before, with critical single-family structures taking the lead in both periods. For the sixth month in a row, housing starts lagged the level set before the pandemic, which was the fastest pace of building since late 2006. Housing permits – an indication of future housing construction – rose almost 5% from July and were down 6.5% from August 2023. The pace of houses under construction remained among the highest in 50 years, though it was about 12% below the all-time peak set two years ago.

The policy-making body of the Federal Reserve Board reduced short-term lending rates and signaled more cuts are on the horizon. The Federal Open Market Committee reversed two and a half years of efforts to combat inflation by raising interest rates to their highest level in more than 20 years. The Fed’s aggressive half-point cut in the fed funds rate signaled its confidence in taming inflation while shifting attention to the health of the labor market.

Thursday

The four-week moving average for initial unemployment claims declined for the fifth time in six weeks. The measure was 38% below the all-time average and the lowest since early June, according to data from the Labor Department, a sign of employers’ continued reluctance to let workers go. Barely 1.7 million Americans were receiving jobless benefits in the latest week, down from 5% the week before but up 3% from the year before.

The annual rate of existing home sales fell in August for the fifth time in six months, dropping 2.5% from July’s pace and down more than 4% from the year before. The National Association of Realtors said an increase in inventory and a decrease in mortgage rates should boost sales activity in coming months. The median sales price hit $416,700 in August, up 3% from the year before and the 14th consecutive month of year-to-year price increases.

The Conference Board’s index of leading economic indicators declined in August for the sixth month in a row. The index fell 0.2% from July because of weaker factory orders, consumer expectations and stock prices as well as a negative interest rate spread. But August’s decline was less than July’s, and the six-month slide of 2.3% compared to a 2.7% setback in the previous six months. The business research group projected weaker economic growth for the rest of 2024 but said activity should pick up in 2025 because of the Fed’s plans to lower interest rates.

Friday

No major announcements

Market Closings for the Week

- Nasdaq – 17948, up 264 points or 1.5%

- Standard & Poor’s 500 – 5703, up 77 points or 1.4%

- Dow Jones Industrial – 42062, up 668 points or 1.6%

- 10-year U.S. Treasury Note – 3.73%, up 0.08 point

138 episodes

Tous les épisodes

×Bienvenue sur Lecteur FM!

Lecteur FM recherche sur Internet des podcasts de haute qualité que vous pourrez apprécier dès maintenant. C'est la meilleure application de podcast et fonctionne sur Android, iPhone et le Web. Inscrivez-vous pour synchroniser les abonnements sur tous les appareils.