Mettez-vous hors ligne avec l'application Player FM !

Money Talk Podcast, Friday Aug. 2, 2024

Manage episode 432172800 series 1036924

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (July 29-Aug. 2, 2024)

Significant economic indicators & reports

Monday

No major releases

Tuesday

The year-to-year change in residential prices slowed in May but continued to outpace inflation overall. The S&P CoreLogic Case-Shiller national home price index rose 5.9% from the year before, compared to a 6.4% gain in April. Month to month, seasonally adjusted prices increased 0.3%, the same as in April. Through the first five months of 2024, though, prices rose 4.1%, the fastest pace in two years. A spokesperson for S&P suggested that home buyers who are waiting for mortgage rates to drop are playing a costly game.

The Conference Board said its consumer confidence index rose slightly in July, though it stayed in a narrow weak range in which it has hovered for two years. The business research group said consumer improved their expectations while marginally lowering their opinions of current conditions. Prices, interest rates and uncertainty continued to cloud consumers’ confidence. Expectations remained at a level associated with economic recession.

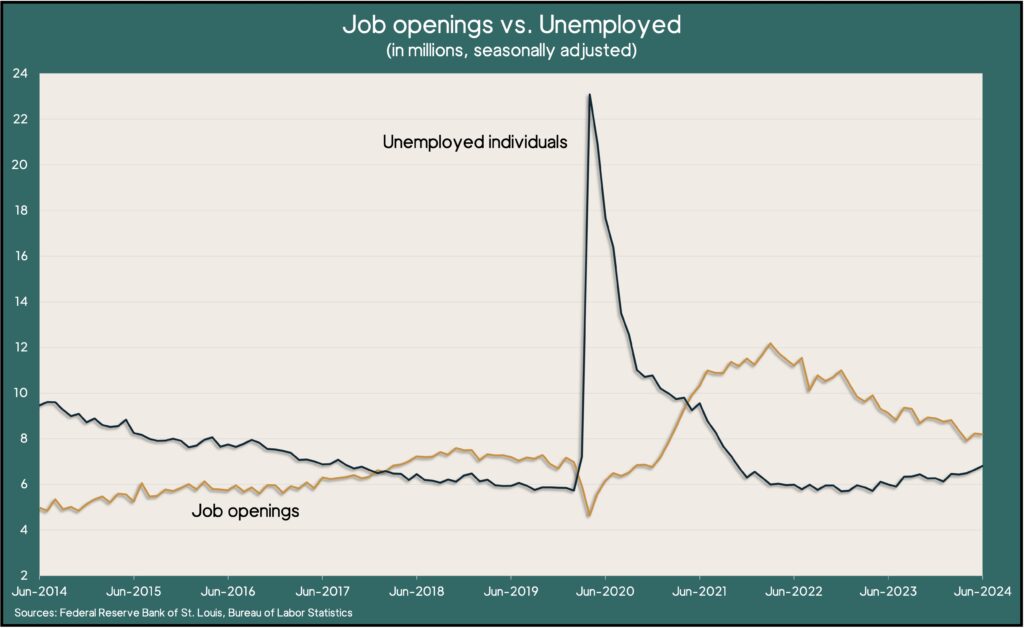

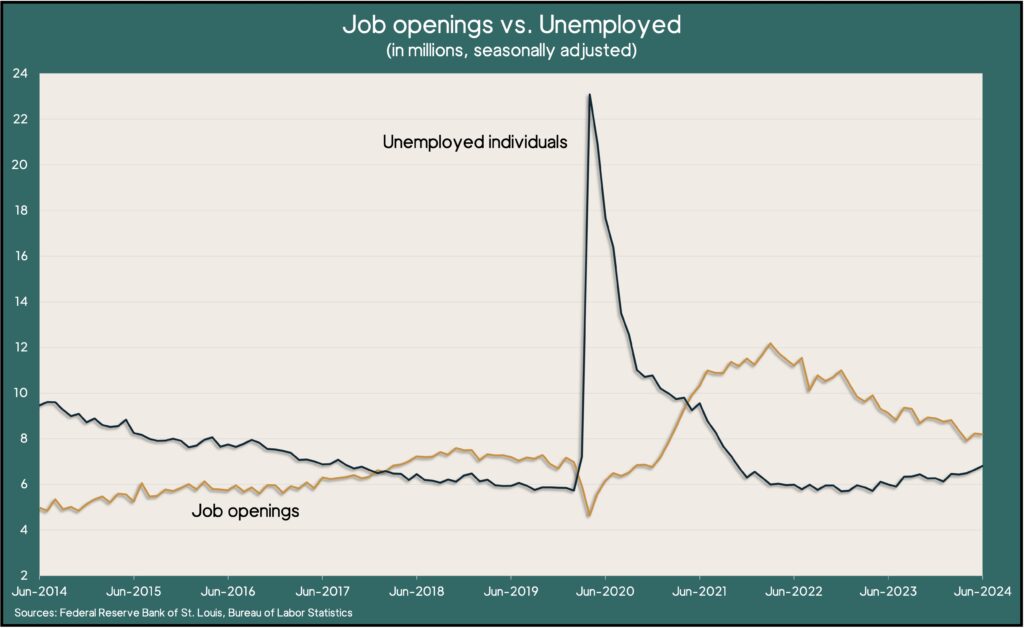

Employers’ demand for workers eased slightly in June, with job openings falling to the narrowest gap with the unemployment level in three years. The Bureau of Labor Statistics said openings fell below 8.2 million, down from a peak of 12 million in 2022 yet still above the 7 million registered just before the COVID-19 pandemic. Employers hired the fewest number of workers since April 2020. And the number of workers quitting their jobs was the lowest since February 2021, suggesting lower confidence in finding new work.

Wednesday

Contending that larger inventories are beginning to help the housing market, the National Association of Realtors reported its pending home sales index rose by 4.8% in June. The trade group’s chief economist credited a gradual increase in the number of houses for sale and added, “Multiple offers are less intense, and buyers are in a more favorable position.” Contract signings still lagged 2.6% behind the June 2023 index.

Thursday

Worker productivity increased at a solid 2.3% annual rate in the second quarter, the Bureau of Labor Statistics reported. The gain came on 3.3% higher output with workers putting in 1% more hours. Year to year, productivity rose 2.7%. Unit labor costs rose at a 0.9% annual rate and rose 0.5% from the year before. In the current business cycle, which began at the end of 2019, productivity has been growing at a 1.6% annual pace, compared to a 1.5% rate during the previous cycle, which started in 2007. The average productivity rate since 1947 is 2.1%.

The four-week moving average for initial unemployment claims rose for the seventh time in eight weeks, reaching its highest level in more than a year. Labor Department data shows that the measure of employers’ willingness to let go of workers was 35% below the all-time average. It was 14% higher than it was just before the COVID-19 pandemic. More than 1.9 million Americans claimed jobless benefits in the latest week, down 1.6% from the week before but up 4.2% from the same time last year.

The manufacturing sector contracted in July for the fourth month in a row and the 20th time in 21 months, according to the Institute for Supply Management. The trade group’s index, based on surveys of purchasing managers, showed the weakest signs of the industry since November. In issuing the report, the ISM said, “Demand was weak again, output declined, and inputs stayed generally accommodative.”

The Commerce Department said construction spending declined in June for the second month in a row, dipping 0.3% from the seasonally adjusted annual pace in May. Housing, which accounted for 44% of all construction spending, pulled back 0.4%, led by a downturn in single-family residences. Year to year, total construction spending was 6% ahead of the June 2023 pace. Spending on residential building – again led by single-family structures – rose 7% from the year before. n increased 80% from June 2022.

Friday

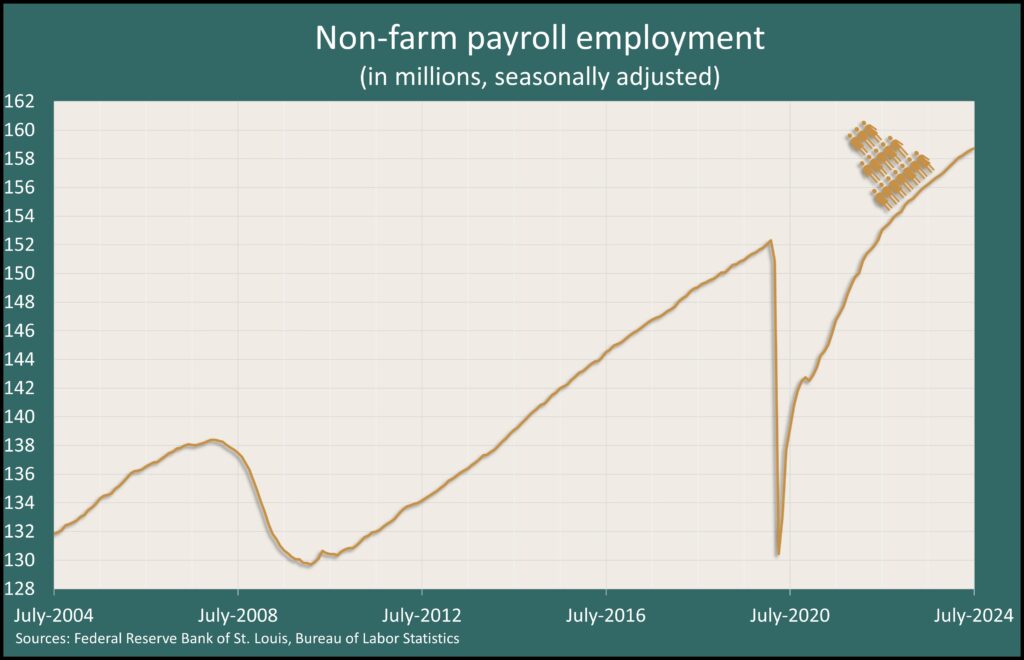

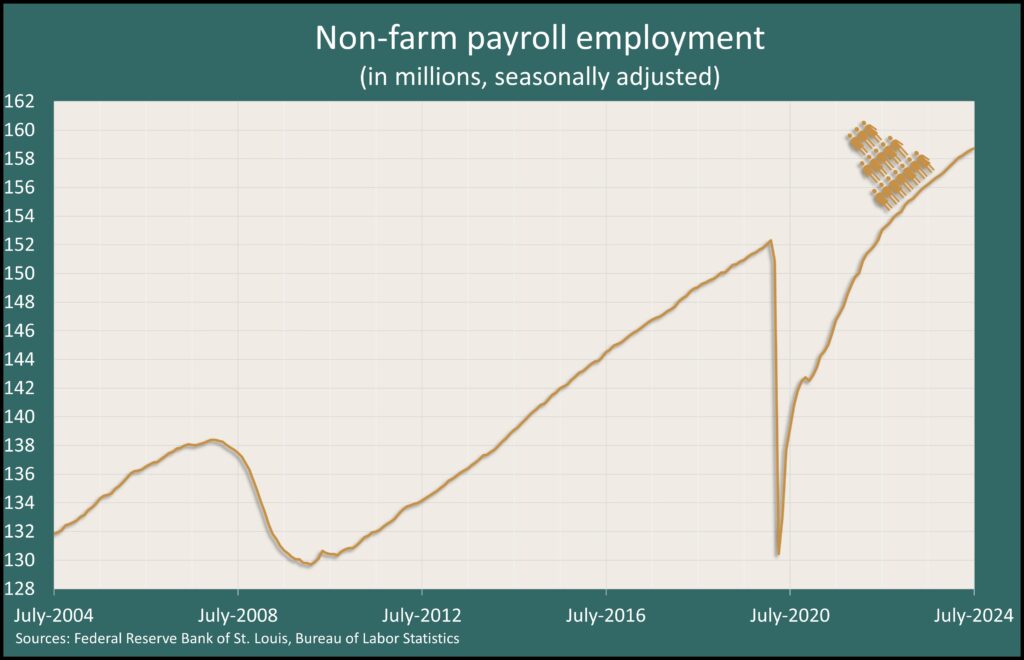

U.S. employers added 114,000 jobs in July, according to the employment situation report from the Bureau of Labor Statistics. Next to April, it was the fewest jobs added in 43 consecutive months of gains as signs of a weaker labor market appeared. The unemployment rate rose to 4.3%, and the U-6 underemployment rate reached 7.8%, both the highest since October 2021 and higher than their levels just before the COVID-19 pandemic. Employment in temporary help services – often a harbinger of job conditions – hit its lowest level in 23 years.

A deep drop in demand for commercial aircraft and parts sank factory orders in June. The Commerce Department reported that total orders declined 3.3% from May and were down 0.1% from June 2023. Excluding volatile orders for transportation equipment, orders rose 0.1% for the month and were up 1.6% from the year before. Core capital goods orders, a proxy for business investments, rose 0.9% from May and were up 0.3% from June 2023.

Market Closings for the Week

- Nasdaq – 16776, down 582 points or 3.4%

- Standard & Poor’s 500 – 5346, down 113 points or 2.1%

- Dow Jones Industrial – 39735, down 855 points or 2.1%

- 10-year U.S. Treasury Note – 3.80%, down 0.40 point

129 episodes

Manage episode 432172800 series 1036924

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (July 29-Aug. 2, 2024)

Significant economic indicators & reports

Monday

No major releases

Tuesday

The year-to-year change in residential prices slowed in May but continued to outpace inflation overall. The S&P CoreLogic Case-Shiller national home price index rose 5.9% from the year before, compared to a 6.4% gain in April. Month to month, seasonally adjusted prices increased 0.3%, the same as in April. Through the first five months of 2024, though, prices rose 4.1%, the fastest pace in two years. A spokesperson for S&P suggested that home buyers who are waiting for mortgage rates to drop are playing a costly game.

The Conference Board said its consumer confidence index rose slightly in July, though it stayed in a narrow weak range in which it has hovered for two years. The business research group said consumer improved their expectations while marginally lowering their opinions of current conditions. Prices, interest rates and uncertainty continued to cloud consumers’ confidence. Expectations remained at a level associated with economic recession.

Employers’ demand for workers eased slightly in June, with job openings falling to the narrowest gap with the unemployment level in three years. The Bureau of Labor Statistics said openings fell below 8.2 million, down from a peak of 12 million in 2022 yet still above the 7 million registered just before the COVID-19 pandemic. Employers hired the fewest number of workers since April 2020. And the number of workers quitting their jobs was the lowest since February 2021, suggesting lower confidence in finding new work.

Wednesday

Contending that larger inventories are beginning to help the housing market, the National Association of Realtors reported its pending home sales index rose by 4.8% in June. The trade group’s chief economist credited a gradual increase in the number of houses for sale and added, “Multiple offers are less intense, and buyers are in a more favorable position.” Contract signings still lagged 2.6% behind the June 2023 index.

Thursday

Worker productivity increased at a solid 2.3% annual rate in the second quarter, the Bureau of Labor Statistics reported. The gain came on 3.3% higher output with workers putting in 1% more hours. Year to year, productivity rose 2.7%. Unit labor costs rose at a 0.9% annual rate and rose 0.5% from the year before. In the current business cycle, which began at the end of 2019, productivity has been growing at a 1.6% annual pace, compared to a 1.5% rate during the previous cycle, which started in 2007. The average productivity rate since 1947 is 2.1%.

The four-week moving average for initial unemployment claims rose for the seventh time in eight weeks, reaching its highest level in more than a year. Labor Department data shows that the measure of employers’ willingness to let go of workers was 35% below the all-time average. It was 14% higher than it was just before the COVID-19 pandemic. More than 1.9 million Americans claimed jobless benefits in the latest week, down 1.6% from the week before but up 4.2% from the same time last year.

The manufacturing sector contracted in July for the fourth month in a row and the 20th time in 21 months, according to the Institute for Supply Management. The trade group’s index, based on surveys of purchasing managers, showed the weakest signs of the industry since November. In issuing the report, the ISM said, “Demand was weak again, output declined, and inputs stayed generally accommodative.”

The Commerce Department said construction spending declined in June for the second month in a row, dipping 0.3% from the seasonally adjusted annual pace in May. Housing, which accounted for 44% of all construction spending, pulled back 0.4%, led by a downturn in single-family residences. Year to year, total construction spending was 6% ahead of the June 2023 pace. Spending on residential building – again led by single-family structures – rose 7% from the year before. n increased 80% from June 2022.

Friday

U.S. employers added 114,000 jobs in July, according to the employment situation report from the Bureau of Labor Statistics. Next to April, it was the fewest jobs added in 43 consecutive months of gains as signs of a weaker labor market appeared. The unemployment rate rose to 4.3%, and the U-6 underemployment rate reached 7.8%, both the highest since October 2021 and higher than their levels just before the COVID-19 pandemic. Employment in temporary help services – often a harbinger of job conditions – hit its lowest level in 23 years.

A deep drop in demand for commercial aircraft and parts sank factory orders in June. The Commerce Department reported that total orders declined 3.3% from May and were down 0.1% from June 2023. Excluding volatile orders for transportation equipment, orders rose 0.1% for the month and were up 1.6% from the year before. Core capital goods orders, a proxy for business investments, rose 0.9% from May and were up 0.3% from June 2023.

Market Closings for the Week

- Nasdaq – 16776, down 582 points or 3.4%

- Standard & Poor’s 500 – 5346, down 113 points or 2.1%

- Dow Jones Industrial – 39735, down 855 points or 2.1%

- 10-year U.S. Treasury Note – 3.80%, down 0.40 point

129 episodes

Tous les épisodes

×Bienvenue sur Lecteur FM!

Lecteur FM recherche sur Internet des podcasts de haute qualité que vous pourrez apprécier dès maintenant. C'est la meilleure application de podcast et fonctionne sur Android, iPhone et le Web. Inscrivez-vous pour synchroniser les abonnements sur tous les appareils.